Company size: Serie A

-

Epishine raises 69 MSEK

(Linköping, captures indoor light to make electronics self-powered): Has raised 69 MSEK in a funding round from Pareto Securities. John Vigo Carlund, Jula Miljö & Energi, Klimatet Invest and founding member Karl-Johan Persson. Epishine was valued at 300 MSEK in the round.

-

Cellugy raise 4.9 MEUR

(Søborg, developing innovative, natural, bio-fabricated cellulose-based solutions to replace fossil-based materials in various industrial applications): Has raised 4.9 MEUR in a funding round from EIFO, ICIGVentures, Joyance Partners, PSV DeepTech, The Footprint Firm, and Unconventional Ventures with members Nora Bavey and Thea Messel. “Reliance on fossil-based petrochemical ingredients is today’s most critical sustainability issue in producing personal care products. With our technology, we genuinely see…

-

Syre raises 1.1 billion SEK

(Stockholm, a textile impact company decarbonizing the industry through textile-to-textile recycling): Has raised 1.1 billion SEK in a funding round from Giant Ventures, Norrsken, Imas, Volvo Cars and H&M with founding member Karl-Johan Persson. The plan is to use the funds to build a pilot factory in the US.

-

Carla raises 8 MSEK

(Stockholm, a marketplace for electric cars and plug-in hybrids): Has raised 8 MSEK in a funding round from Verdane with member Henrik Aspén. Early investors include founding member Karl-Johan Persson and Inbox Capital, with founding member Martin Wattin. Last year, Carla had a turnover of 665 MSEK. We think it’s positive that electric cars are becoming available to more people. “We also see that…

-

Blykalla raises 80 MSEK

(Stockholm, is developing and building small modular lead-cooled reactors to deliver clean energy): Has raised 80 MSEK in a funding round led by Norrsken Launcher with members Erik Engellau-Nilsson, Fredrik Jung Abbou and founding member Ash Pournouri. Nucleation Capital, Earth Venture Capital and Farvatn participated as well. Early investors include founding members Gunilla von Platen and Jacob de Geer. “Three years ago, it was said that it was impossible…

-

Photoncycle raises 5 MEUR

(Oslo, is developing a space-effective and autonomous energy system powered by the sun): Has raised 5 MEUR in a funding round from Lifeline Ventures, Momentum Partners, Eviny Ventures and Luminar Ventures with members Magnus Bergman and Louise Hagen. “The team’s groundbreaking work in energy storage has the potential to revolutionize how we approach renewable energy, making European households energy self-sufficient,” comments Jacob Key, Founding Partner…

-

Onego Bio raises 40 MUSD

(Helsinki, produces animal-free egg protein via precision fermentation): Has raised 40 MUSD in a funding round led by NordicNinja VC with founding member Claes Mikko Nilsen. Tesi, EIT, Agronomics, Maki.vc, Holdix, Business Finland and Turret also participated. Onego Bios Series A funding round is one of the largest A-rounds lately in the Nordics, bringing the company’s total funding to 56 million USD.

-

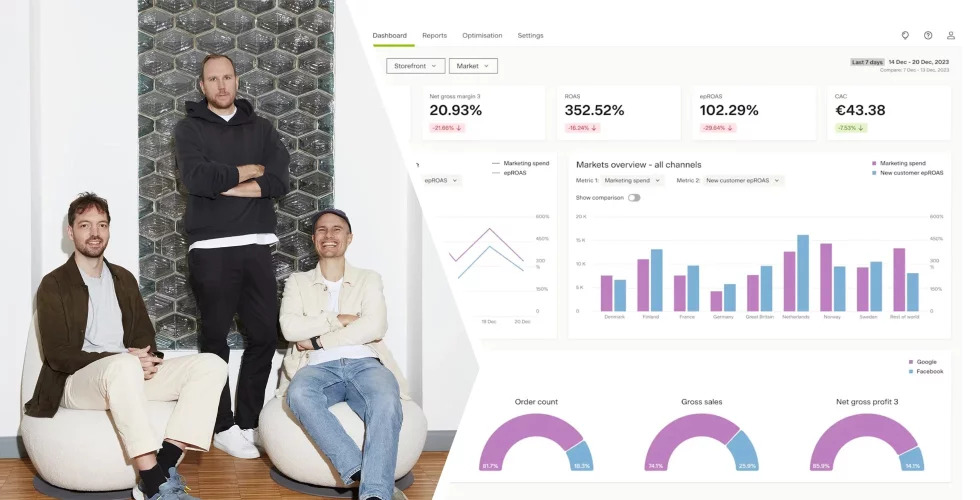

Dema.ai raises 70 MSEK

(Stockholm, a platform delivering actionable insights for eComm businesses to achieve profitable growth): Has raised 70 MSEK in a funding round from Daphni, J12 and early investors including members Erik Segerborg, Kim Fai Kok and founding member Ash Pournouri. “The e-commerce industry is undergoing fundamental changes, and we want to continue to be at the forefront with the latest technology and lead…

-

Cellcolabs raises 90 MSEK

(Stockholm, mass production of stem cells): Has raised 90 MSEK in a funding round led by Jens von Bahr and Fredrik Österberg. Also participating is Nordic Angels‘ latest initiative ACAP, which, along with 4 members, has invested 12 million in Cellcolabs. Read more about ACAP below. Cellcolabs is now accelerating its efforts to mass-produce stem cells for the global market. Do you also want to…

-

Cetti raises 16 MSEK

(Uppsala, an integrated real estate transaction solution between sellers, buyers, brokers, and banks from advertising to signing): Has raised 16 MSEK in a funding round from Johan Tjärnberg, Oliver Hildebrandt, Christian Frick and member Michael Wolf. Cetti handles around 25% of all real estate transactions and is used by over 50% of Sweden’s real estate brokers.