Area of interest: Funding

-

FinestLoveVC secures 10 MEUR

(Helsinki, a VC that supports high school and university student startups in the Finest Bay Area): Has secured 10 MEUR for its new fund. Led by Peter Vesterbacka and member Kustaa Valtonen, FinestLoveVC plans to launch 100 funds totaling 1 billion EUR in the coming years.

-

Verdane secures 12 billion SEK

(Oslo, a venture capital firm specializing in tech and sustainability): Has secured 12 billion SEK for its new fund. In September, Verdane closed another fund, Freya XI, at the same level. This means that they’ve secured 24.6 billion SEK in the last 4 months. “We are standing strong in a troubled time, with a lot of capital to…

-

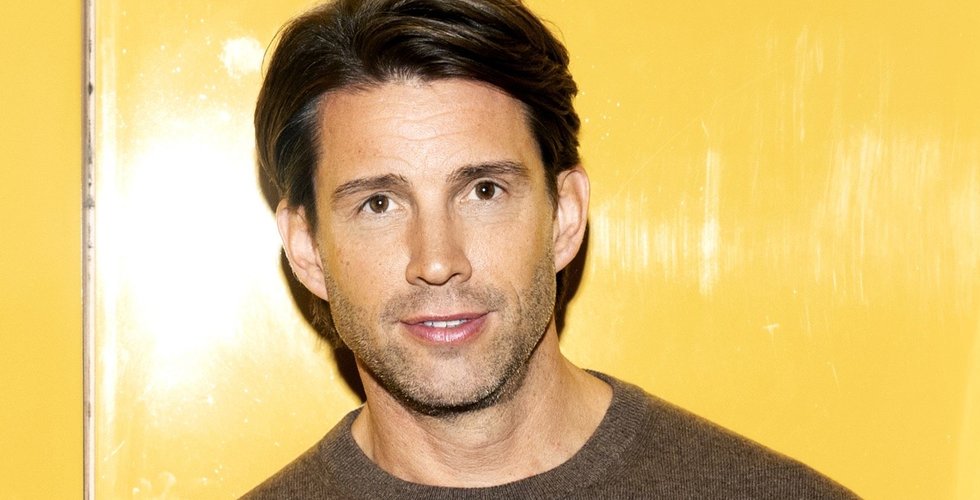

Webrock Ventures secures

Stockholm/São Paulo, a venture studio helping Swedish tech startups expand to Brazil): Has secured 70 MSEK in a funding round from Atlant Fonder and Roosgruppen. Webrock, with member Christian Manhusen as a partner, raised the funding in conjunction with an IPO in February. “The listing on Nasdaq First North Growth Market is a quality stamp and is a natural step in the continued…

-

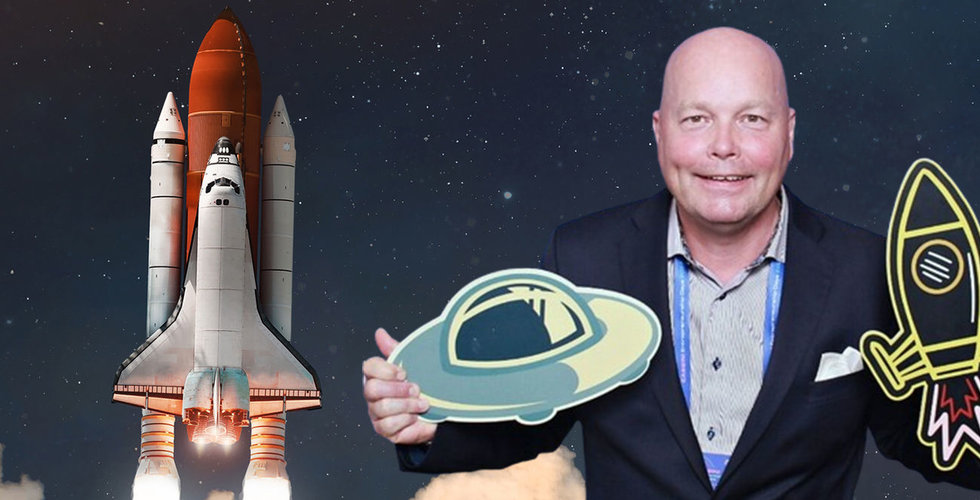

Expansion secures 1 billion SEK

(Stockholm/Paris, a venture capital firm focusing on space and new air mobility): Has secured 1 billion SEK for its first fund from EIF and other investors. “Space has become a very important infrastructure for everyone. For example, 60 percent of all sustainability data comes from satellites. It’s extremely important for maritime, forest and forest fires, agriculture, heat…

-

Kost Capital secures 25 MEUR

(Copenhagen, a VC fund providing pre-seed and seed funding for early-stage bio-economy startups): Has secured 25 MEUR for its new fund. “We all need to eat, but the food system is broken. A growing population, climate change, food waste, health issues, and policy changes require rapid funding now to ensure sustainability, efficiency, and resilience in…

-

Oxx secures 2 billion SEK

(Stockholm/London, an investment firm focusing on SaaS growth companies): Has secured 2 billion SEK for its second fund from investors including Saminvest, British Patient Capital, KfW Capital, and Argentum. Oxx, with member Ingrid Bonde Åkerlind as a Principal, is a specialist VC in European B2B SaaS companies at the scale-up stage.

-

Trio Impact Invest secures 150 MSEK

(Stockholm, a collaboration between KTH, Karolinska Institutet, and Stockholm University investing in innovation targetting the world’s biggest challenges with breakthrough science): Has secured a grant of 43 MSEK from Tillväxtverket with a commitment of a total of 150 MSEK in funding. “It’s easy to look at sustainability, but we think more about societal impact, meaning all the UN’s global goals. We…

-

Norrsken22 secures 2.3 billion SEK

(Africa/Stockholm, a technology growth fund partnering with entrepreneurs building Africa’s next tech giants): Has secured 2.3 billion SEK for its pan-African fund. Norrsken22 was launched in January last year and then closed a round of over 1 billion SEK, more than half of which came from a consortium consisting of 30 global unicorn founders. Early investors in Norrsken22 include…

-

ByWIT secures 90 MSEK

(Stockholm, an investment firm focusing on high-growth digital companies): Has secured 90 MSEK to its new fund. Investors backing the fund include Coeli with founding member Mikael Larsson. “By WIT has a clear strategy to invest long-term in digital growth companies that create structural change and streamline the industries in which they operate. In the recession we are currently…

-

Luminar Ventures secures 715 MSEK

(Stockholm, a VC with a focus on investing in Nordic digital companies at the seed stage): Has secured 715 MSEK to its new fund. Investors include the European Investment Fund EIF, Saminvest, the Church of Sweden, Ericsson’s pension fund, and several private investors. “Even if we find ourselves in challenging times, we see this as a golden opportunity to invest…