Location: Sweden

-

Oatlaws raises 13 MSEK

(Stockholm, a foodtech brand with clean, vegan, and nutrient-packed food): Has raised 13 MSEK from its founders Joel Kinnaman, founding member Ash Pournouri and Nicoya with founding member Christopher Slim. Last year, Oatlaws tripled its sales and reached revenues of 9.7 million SEK.

-

Apica raises 108 MSEK

(Stockholm, a SaaS company for IT monitoring and optimization of web applications): Has raised 108 MSEK in a funding round from Industrifonden with member Peter Wolpert, Oxx Ventures with member Ingrid Bonde Åkerlind, and SEB Foundation. In conjunction with the round, Apica acquired Logiq.ai, a Bangalore-based observability data fabric startup. With the acquisition and the…

-

Peas of Heaven raises 4.7 MSEK

(Härryda, plant-based alternatives to meat): Has raised 4.7 MSEK in a funding round from Uchu AB (Härryda, plant-based alternatives to meat): Has raised 4.7 MSEK in a funding round from Uchu AB with Nils Tham, Anders Boye-Møller and Daniel Hegardson, Karlssons Charkuterifabrik and Nicoya with founding member Christopher Slim. In 2022, Peas of Heaven increased…

-

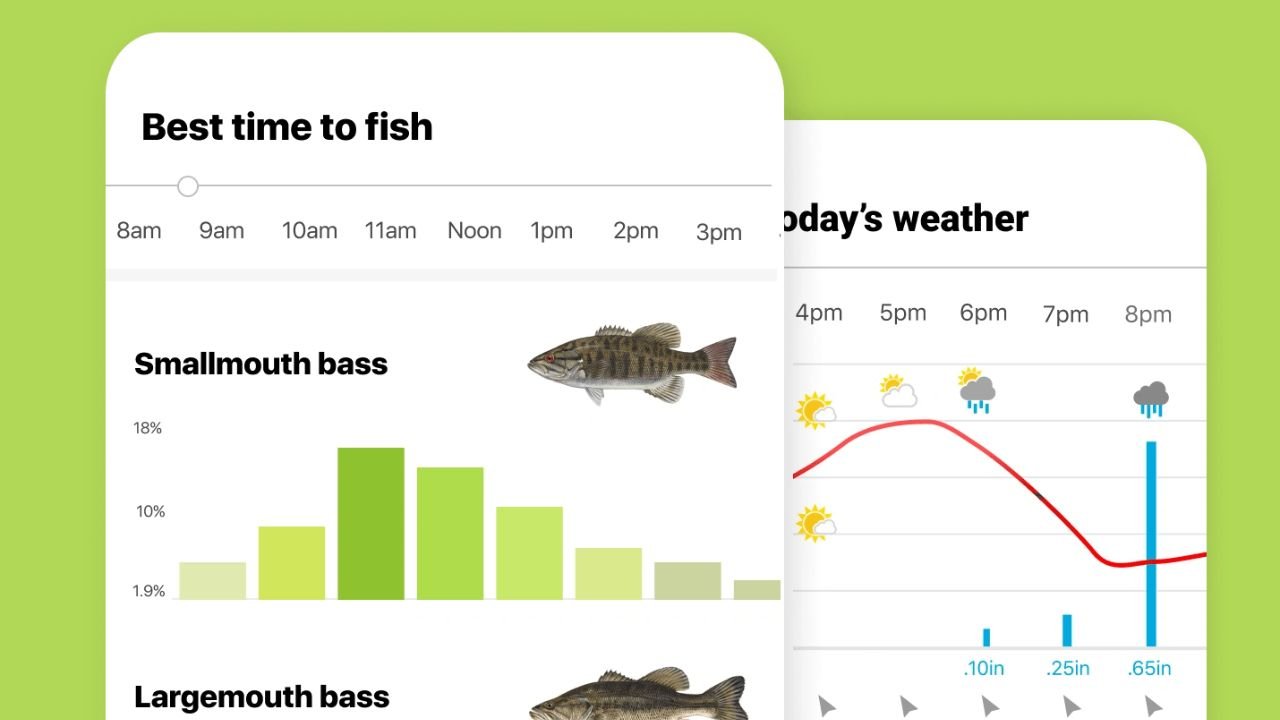

Fishbrain raises 6 MUSD

(Stockholm, a platform where keen fishing people can become part of an online fishing community, share their catches in social media-styled posts, and find the best fishing spots): Has raised 6 MUSD in a funding round from Lucerne and Industrifonden with member Peter Wolpert. Early investors include Inbox Capital with founding member Martin Wattin. The…

-

Sportscom raises 5 MSEK

(Helsingborg, a platform that lets you listen to live sports): Has raised 5 MSEK in a funding round from Loop Capital, Jonas Tellander, Karl Andersson, and member Ann Grevelius. By signing up for 69 kronor a month, the listener can through an app, access complete commentary from matches in the SHL, Allsvenskan, and Premier League.

-

CodeScene raises 87 MSEK

(Malmö, a next-generation software engineering intelligence tool that can predict malfunctions in code): Has raised 87 MSEK in a funding round led by Neqst. Existing investors Luminar Ventures with members Magnus Bergman and Louise Hagen alongside Inventure with members Rebecka Löthman Rydå and Gwen Sandberg participated as well. CodeScene was valued at 252 MSEK in…

-

Yepstr raises 7 MSEK

(Stockholm, a gig platform that offers home assistance from talented young people in local areas): Has raised 7 MSEK in a funding round from existing investors. Early investors in Yepstr include founding members Gunilla von Platen, Johan Siwers, and Lars Lindgren. “We have boosted our turnover and are quickly approaching profitability,” comments member Jacob Rudbäck,…

-

Lesslie raises 10.1 MSEK

(Stockholm, a platform for smooth cross-border payments): Has raised 10.1 MSEK in a funding round from existing investors. Early investors in Lesslie include members Noel Abdayem, Willem De Geer and Njord Ventures with member Andreas Anderberg. Lesslie was valued at 130 MSEK in the transaction.

-

Drifter World raises 10 MSEK

(Hissings Backa, an AI-powered parking management system): Has raised 10 MSEK in a funding round from Imperia Fastigheter. Drifter World offers seamless payment solutions, detects violations, optimizes parking spaces, and provides real-time occupancy and environmental data for parking spaces. Amongst the founders of Drifter World is member Michael Persson who is also chairman.

-

Kommunresurs raises 6 MSEK

(Oskarshamn, offers digital solutions and consulting services in finance for the municipal and public sectors): Has raised 6 MSEK in a funding round from proptech investor AGV Invest, where early investors include members Maria Rankka and Noel Abdayem. “We are very pleased that AGV Invest has chosen to invest in the company. We look forward…